No. According to the CRA, “the CCR is not subject to a benefit reduction based on adjusted family net income.”

Canada’s Carbon Rebate: A 2024 Guide

On April 1, 2024, the federal government increased the carbon tax from $65 per tonne to $80 per tonne, making fossil fuels more expensive.

This carbon tax is meant to incentivize Canadians to make greener choices by raising the cost of polluting fuels, such as gasoline and diesel. The most recent hike increased the price for gasoline by 3.3 cents per litre, and since the tax was first introduced in 2019, the cost has gone up by 17.6 cents per litre. However, to help offset that carbon tax, the federal government also pays a Canada carbon rebate to all eligible Canadians who are impacted by this pollution pricing. As the carbon tax goes up, so does the rebate.

Below we explain how the carbon rebate works, who qualifies for it and how much you can expect to get back.

What Is the Canada Carbon Rebate?

The Canada Carbon Rebate (CCR) is a tax-free benefit to help eligible individuals and families offset the cost of the federal pollution pricing.

The rebate is paid to eligible Canadians in provinces that are impacted by the federal carbon pricing. As B.C., Quebec and Northwest Territories have their own carbon pricing programs ( the B.C. and NWT programs are similar to the federal plan while Quebec uses a cap-and-trade system), residents of those provinces are not eligible for the federal rebate.

From 2018 to 2020 the rebate was known as the climate action incentive, or CAI. From 2021 to 2023 it was known as the climate action incentive payment (CAIP). It was rebranded as the Canada carbon rebate in early 2024.

How Does the Canada Carbon Rebate Work?

The CCR is paid to all eligible Canadians four times a year: April 15, June 15, October 15 and January 15. Eligibility is based on your province of residence as well as how many people live in your household and your province of residence. There is also a supplement for residents of small and rural communities. You do not need to apply for the CCR; you only need to file your income tax each year.

According to the Parliamentary Budget Office, approximately 80% of Canadians receive more from the rebates than they pay in carbon tax.

The reasoning for both the carbon tax and rebate is this: the carbon tax is meant to encourage people to choose less polluting fuel options, such as using public transit or buying a hybrid car. You only pay the tax when you’re purchasing fossil fuels, but you receive the rebate regardless. So if you reduce your spending on fossil fuels, you get to keep more money in your pocket via the rebate. The rebate is intended to cover the differential cost of carbon pollution pricing (that is, the portion of your fuel bill that goes towards the tax), not your fuel costs.

How Much Is the Canada Carbon Rebate?

In January 2024, approximately $2.3 billion in carbon tax rebates were paid to approximately 12 million Canadians. The amount of CCR that you receive depends on your province and the number of eligible people in your household.

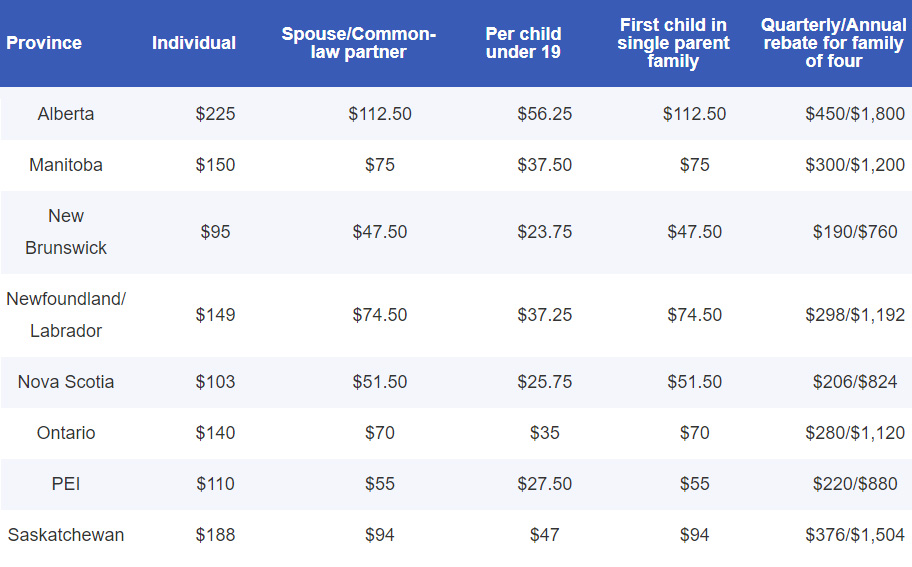

Here is a breakdown of the current base amount of each quarterly payment and what that payment looks like for a family of four (two adults, two children):

There is also a rural supplement of 20% above the base amount that is given to residents outside of city centres due to their reliance on fossil fuels and limited options for greener alternatives. (Before April 1, 2024, the rural supplement was 10% of the base amount.) This means that while a household of four in Calgary would get an annual rebate of $1,800, a household of four in Bragg Creek, Alberta (population 432 in 2021) would receive $2,160.

The rural supplement applies to residents of Alberta, Saskatchewan, Manitoba, Ontario, Newfoundland and Labrador, New Brunswick and Nova Scotia whose primary residence is outside a census metropolitan area (CMA), which has a total population of at least 100,000. According to the 2021 census, 84% of Canada’s population lives within a CMA, and more than half of the population live in the 10 largest CMAs (the top three are Toronto, Montreal and Vancouver). All eligible recipients of the CCR in PEI are eligible for the rural supplement. You can look up whether you are eligible for the rural supplement here.

Who Qualifies for the Canada Carbon Rebate?

To be eligible for the CCR, these conditions must be met:

- You are a resident of Canada in the month before the payment.

- You are a resident of Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, PEI or Saskatchewan.

- You are 19 years old or older. (You’re eligible if you’re less than 19 if you have a spouse/common-law partner or you are a parent and live with your child.)

You have an eligible child if all the following conditions are true:

- Your child is under 19 years of age.

- Your child lives with you. (If you share custody, you will receive 50% of the benefit for that child.)

- You are primarily responsible for the care and upbringing of your child.

- Your child is already registered for the Canada child benefit (CCB) or GST/HST credit.

If you have a spouse or common-law partner, only one of you can receive the payment for the family. The CCR is paid to the person who files their taxes first. The payment is the same regardless of income, so it does not matter who files first. As the CCR is based on your household, both spouses or common-law partners need to file their income tax returns even if there is no income to report.

When Do I Get my Canada Carbon Rebate?

The CCR is paid four times a year: April 15, June 15, October 15 and January 15. To receive the April 15, 2024 payment, you must have filed your tax return electronically by March 15, 2024. If you did not file by that deadline, it will take between six to eight weeks after your return is assessed to receive your rebate.

If you are already set up to receive your tax refund by direct deposit, you will also receive your CCR by direct deposit. The transactions should have a reference name of “Canada Carbon Rebate” but as banks have no obligation to use the description text as supplied by the federal government, the deposit may look like something else, such as “Canada Fed.” You can log in to My Account on the CRA website to check when you are scheduled to receive your next payment.

Frequently Asked Questions (FAQs)

Is there an income threshold for the Canada carbon rebate?

How can I apply for the Canada carbon rebate?

You don’t need to apply for the CCR. You just need to file your tax return each year. The CRA assesses your payment by the information you report in your tax return, such as your province of residence and the number of people in your household.

Why did I not receive the Canada carbon rebate?

If you think you are eligible for the rebate but you did not receive it, it may be because you have not yet filed your most recent tax return. If you filed your taxes electronically by March 15, 2024, you should receive your CCR payment on April 15, 2024. Otherwise, it will take six to eight weeks after your return has been assessed. In addition, if you have an outstanding tax debt with the CRA, your rebate will be applied to that debt first before you receive any payment.

Are the Canada carbon rebate amounts taxable?

No. The CCR is not considered taxable income. It is a tax-free benefit given to all eligible Canadians.

What are the payment dates for the Canada carbon rebate?

The scheduled payment dates for the CCR are April 15, June 15, October 15 and January 15. When the 15th falls on a weekend or federal statutory holiday, the payment will be made on the last business day before the 15th. If you are already set up to receive your tax refund by direct deposit, you will also receive your CCR by direct deposit.

Why does Canada have a carbon tax?

The federal government touts the carbon tax as the cheapest way to reduce the pollution causing climate change by incentivizing Canadians to choose greener options. Canada has the ambitious target to reduce greenhouse gas emissions by 40% to 45% below 2005 levels when emissions per capita were 23 tonnes of CO2 equivalent per person, an increase of nearly 10% over 1990 levels. In 2005, Canada’s total GHG emissions were 731 megatonnes, representing about 2% of overall global GHG emissions.